Contents:

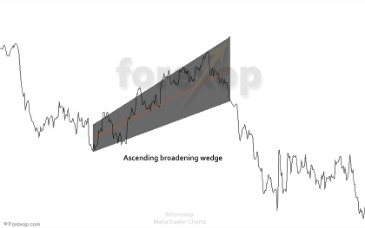

It is a type of pattern development in which trade operations are limited to convergent straight lines, thereby making a pattern. The wedge normally requires roughly 3 to 4 weeks to finish its formation. This formation has a tilted slant that rises or falls in the same way. But Bitcoin’s upside run met resistance with a surprising global market sell-off in February and March 2020.

- First, to achieve an equivalent slope, the convergent trend lines must be converging.

- From the above chart, we can interpret that the momentum of the downtrend is slowing down.

- As a continuation pattern, the falling wedge will still slope down, but the slope will be against the prevailing uptrend.

- Please enable JavaScript or switch to a supported browser to continue using twitter.com.

Your daily dose of Market analysis & Price updates. Down for either a short wick down to the $36K level along the support line , but prior to that will have to re-test the $37,716. Trading poses a risk of losing some or all of your money and it will be your responsibility if you lose money.

Buy or hodl, says investor Raoul Pal as Bitcoin price chart hints at ‘falling wedge’

The illustration below is a perfect example of this pattern. The price of Litecoin has been reflecting an upswing since December 2022. Later, the coin plummets below $120, forming a falling wedge. The wedge encounters a correction at $130 and reflects an immediate rally. Bitcoin price edges closer to the lower limit of its bullish structure after Thursday’s market sell-off. This move has also caused many altcoin traders to be caught off guard leading to $65 million in liquidations.

Monero ‘falling wedge’ breakout positions XMR price for 75% rally – Cointelegraph

Monero ‘falling wedge’ breakout positions XMR price for 75% rally.

Posted: Sun, 24 Apr 2022 07:00:00 GMT [source]

Then, the breaking point arrives and the trading activities change. It is more likely for the prices to drift laterally and saucer-out as they exit the precise boundary lines of the falling wedge pattern before resuming the primary trend. When the market produces lower lows and lower highs with a narrowing range, the chart pattern known as a falling wedge is formed.

Technical indicator

We do not allow any sharing of private or personal contact or other information about any individual or organization. This will result in immediate suspension of the commentor and his or her account. In addition, any of the above-mentioned violations may result in suspension of your account. This move could potentially trigger an influx of sidelined buyers, starting a buying spree and pushing the remittance token to $1.67. The ascent from the current price to $1.672 would represent an 81% climb. While things seem to be leaning bullish, a failure to recover BTC at $41,126 will indicate that the buyers are not ready.

Ethereum price set up three distinctive lower highs and two lower lows since August 31. Connecting these swing points shows the formation of a descending parallel channel. While ETH bounced off the middle line of the channel, it is currently retesting the upper trend line in hopes of a breakout.

As a pandemic loomed over the world and sent people in self-inflicted lockdowns, the business activity collapsed. Ideally, the https://g-markets.net/ could have blasted towards $11,679 per a Falling Wedge’s technical description. The definition reads that a successful Wedge breakout would rise by as much as the height between the pattern’s highest high and highest low. That is represented via the purple dotted lines in the chart above. It typically leads to the price breaking above the upper trendline by the maximum wedge length.

Technical Analysis

As with most patterns, it is important to wait for a breakout and combine other aspects of technical analysis to confirm signals. The Falling Wedge Pattern is a chart pattern that signals a bullish momentum. This pattern is the opposite of the rising wedge pattern which has a bearish tone. The falling wedge can be formed as a trend reversal pattern and it can also be a trend continuation pattern . By studying the Falling Wedge Pattern, you will be better prepared to be able to take advantage of buying opportunities if this pattern is formed in the market.

Such a development indicates the formation of a hidden bullish divergence, adding a tailwind to the bullish scenario from a falling wedge perspective. On March 3rd, the BTC price witnessed a significant sell-off and plunged back to the pattern’s support trendline. This strong footing should have assisted buyers in a bullish reversal, but instead, the coin price turned sideways.

Where does the descending wedge occurs?

The falling wedge pattern is a useful pattern that signals future bullish momentum. This article provides a technical approach to trading the falling wedge, using forex and gold examples, and highlights key points to keep in mind when trading this pattern. So shows a textbook technical indicator called Falling Wedge.

This pattern normally develops when the price of an asset has been growing over time, although it may also happen during a downward trend. Rising and falling wedges are only a minor component of a transitional or main trend. XRP will give you a life-time opportunity to buy for an extremely cheap price, around 0.18 USDT! It’s going to happen probably very soon, so make sure you are prepared!

Descending Triangle: An Ultimate Guide To Trade With It On A Crypto Chart

First, to achieve an equivalent falling wedge bitcoin, the convergent trend lines must be converging. Then, a bullish symmetrical triangle must develop in a market with an uptrend, with prices breaking through the top trend line. Lastly, in a downturn, a bearish symmetrical triangle must develop, and prices must break through the bottom trend line. With each successive price increase or wave upwards, volumes continue to decline, showing that market demand is waning at the price that is higher. When a bearish market is established, a rising wedge pattern is comparatively more accurate.

- The simplest approach to notice the narrowing of the channel, which is the initial significant clue that a reversal is brewing, is to use trend lines.

- This technical formation forecasts a 12% upswing to $51,925, obtained by measuring the distance between the first swing high and swing low and adding it to the breakout point.

- The pioneer cryptocurrency is trying to arrest last week’s downtrend, which saw its leg tag $19,543 on the downside.

- Maxx Momentum indicator also shows similarities as momentum turns red throughout the later stages of the falling wedge towards the breakout.

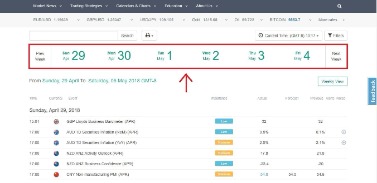

Support and resistance lines help them find these patterns on charts. Over the last 6 Days Bitcoin has seen a 25% pull-back to visible range support around $9,800 from the recent high of $13,200. During this pull-back, another falling wedge has formed visible on all timeframes and could propel price levels back up towards visible range highs over the coming weeks. NewsBTC is a cryptocurrency news service that covers bitcoin news today, technical analysis & forecasts for bitcoin price and other altcoins. Here at NewsBTC, we are dedicated to enlightening everyone about bitcoin and other cryptocurrencies.

You can see a list of supported browsers in our Help Center. Dumped today, almost hitting the $37.2K target I had projected. The cryptocurrency fell by more than 63 percent, from its YTD top of $10,500 to a new low at $3,858. But the fall brought it back inside the Rising Wedge region. The major northward move had appeared out of a Falling Wedge breakout.